As horizontal wells and larger spacing units become the norm, the question often arises how to deal with an unleased federal tract in the proposed drilling unit. Generally, you cannot drill through and produce from an unleased tract of land that is entirely or partially owned by the United States, but there are some options available.

Can I include unleased federal lands in my drilling unit if I don’t penetrate that tract?

Yes, there is precedent where drilling units have been approved and operators have drilled horizontal wells that come close to the boundary of an unleased federal tract, but do not actually penetrate the unleased federal tract. The BLM Manual and the BLM Handbook specifically provide that a communitization agreement (CA) can be approved with unleased federal lands if there is at least one other leased tract (federal, state, fee, or Indian), there is a well producing in paying quantities, and it would be a long delay (i.e., more than six months) in leasing the unleased federal lands (or presumably if the unleased federal lands are not available for lease).[1]

In regard to the well producing in paying quantities requirement, we note there is nothing in the federal statutes or regulations requiring a producing well. We suspect this requirement exists to determine the well drainage and spacing unit for the lands. If a drilling unit has already been established by the relevant state regulatory body, we do not believe a well producing in paying quantities should be required for approval of a CA with unleased federal lands. The BLM Manual and Handbook also direct that any unleased federal lands should be leased as soon as possible. Any lease subsequently issued will be subject to the successful bidder joining the CA or otherwise showing why joinder should not be required.[2]

If the unleased federal lands are committed to a CA, an interest-bearing account is established and 8/8ths of all proceeds attributable to the unleased federal lands are to be placed in the account. Once the tract is leased, the suspended proceeds will be settled with the successful bidder. In lieu of leasing an unleased federal tract, a compensatory royalty agreement (CRA) for small tracts of unleased lands may also be negotiated.[3] The BLM has specific procedures in place for this situation, which require an unleased lands account to be established for any unleased lands. The CRA must be executed by the United States and all adjoining interest owners in lands draining the unleased federal lands. The royalty rate will typically be the same as the rate for a competitive lease.

Unfortunately, there is no precedent that commitment of the unleased federal lands to a CA and/or CRA gives the operator the right to drill into and produce from the unleased federal lands. There is a potential argument that the BLM’s approval of the CA commits the unleased federal lands to the CA and provides the operator of the CA with full access to all the communitized lands (including drilling on and through the unleased federal lands), but there is no guidance on this point.

What if I drill through, but don’t produce from unleased federal lands?

Yes, it is possible to drill through unleased federal lands so long as they are not perforated or otherwise produced from. This is because, when it comes to federal miners, there is a distinction between subsurface trespass (drilling through but not producing from unleased federal minerals) and mineral trespass (drilling through and producing from unleased federal minerals). It should be noted that the penalties for mineral trespass against the United States can be quite severe.[4]

Although there is a split in jurisdictions (and even inconsistency within certain jurisdictions) as to the ownership of the pore space after the severance of the surface and mineral estates, the BLM generally defers to the surface owner for approval to drill through (but not produce from) unleased federal lands. The BLM will not typically assert any approval authority in this situation unless the federal minerals are at risk of harm or interference.[5] However, a prudent operator may seek a subsurface access agreement from the BLM (even if it is not ultimately granted) to at least notify the BLM of the proposed operations in an effort to protect itself from the risk of subsurface trespass. In some states, when an APD is filed, the state’s oil and gas commission will either send notice or require the operator to send notice to the BLM when federal lands are involved.

What if the tract is only partially unleased federal minerals?

Generally, whether or not federal or state law controls when dealing with federal minerals is a difficult question to answer.[6] When the subject involves the disposition or development of federal minerals, state regulatory authorities generally have no jurisdiction or authority.[7] Specifically, scholars believe that Congress has the ability to preempt conservation regulations under the Supremacy Clause or the Commerce Clause of the Constitution or state regulation of federal lands under the Property Clause of the Constitution.[8]

As a result, it is not clear whether traditional remedies available for a co-tenant (e.g., compulsory pooling) apply to minerals owned in part by the United States. On one hand, a private party attempted to force pool unleased federal minerals and a federal court found that compulsory pooling of federal lands could not be done without the Secretary’s consent, essentially requiring a communitization agreement.[9] On the other hand, courts have found that lands reacquired by the United States are subject to state law.[10]

Furthermore, if the unleased federal minerals are committed to a CA, it would be difficult to argue that development of the unleased federal minerals is a mineral trespass because the Secretary consented to the pooling and development of the unleased federal minerals by approving the CA. Unfortunately, we have not been able to identify a situation where an operator has attempted to develop a partially-owned unleased federal tract as a co-tenant.

In the event an operator is actually

successful at developing a tract with partially federal minerals, a CA will

need to be approved and an interest-bearing account will be established as

discussed above.

[1] BLM Manual 3160-9 Communitization, .1.11.H.; BLM Handbook 3105-1 Cooperative Conservation Provisions, Section II.A.

[2] It is uncertain whether the latter is actually possible due to the fact that a lease within a CA cannot be independently developed.

[3] 43 C.F.R. § 3100.2-1.

[4] In assessing the penalty for mineral trespass of federal minerals, the BLM will first look to state law governing oil trespass to measure damages. If the state where the trespass occurred has no law governing oil trespass, the BLM’s assessment of damages will depend on whether the trespass was “innocent” or “willful.” For innocent trespass, BLM will measure damages based on the value of oil taken, less expenses of “taking” the oil (i.e., drilling costs). For willful trespass, the BLM will measure damages based on the “[v]alue of the oil taken without credit or deduction for the expense incurred by the wrongdoers in getting it.” The BLM’s trespass regulations do not address measurement of damages from gas trespass, but generally state that it will measure damages for “other trespass” based on the laws of the state in which the trespass occurred. See, generally, Kathleen C. Schroder & William Lambert, “Permitting and Trespass Issues Associated with Horizontal Development on Federal Lands and Minerals,” 62 Rocky Mt. Min. L. Inst. 12-1 (2016).

[5] See U.S. Government Accountability Office, Oil and Gas: Updated Guidance, Increased Coordination, and Comprehensive Data Could Improve BLM’s Management and Oversight, GAO-14-234, Published May 5, 2014, Reissued May 16, 2014.

[6] In the astute words of Professor Bruce M. Kramer, “The rules are in flux, which makes it an exciting time for academics and a difficult time for those providing legal advice to oil and gas explorers and producers.”

[7] Kleppe v. New Mexico, 456 U.S. 529, 540 (1976); Kennedy & Mitchell, Inc. 68 IBLA 80, 83 (1982) (finding “Congress has preempted from the state regulation of communitization or drilling agreements affecting Federal oil and gas leases . . . [U]ntil [a] communitization agreement [is] approved . . . each Federal oil and gas lease . . . [has] to stand by itself”).

[8] Owen L. Anderson, “State Conservation Regulation – Single Well Spacing and Pooling – Vis-à-vis Federal and Indian Lands,” Federal Onshore Oil and Gas Pooling and Unitization, 2-12 (Rocky Mt. Min. L. Fdn. 2006).

[9] Kirkpatrick Oil & Gas Co. v. United States, 675 F.2d 1122, 1125 (10th Cir. 1982) (holding “no state-ordered forced pooling would bind the government without the Secretary’s consent”). It appears that obtaining a CA may be the more practical approach because the BLM Manual instructs that, in this situation, the operator should submit a copy of the state order force pooling the interest with the CA and the CA will be approved if executed by the operator and complete in all other respects.

[10] See Mallon Oil Co., 104 IBLA 145, 150 (1988) (applying Montana law as to the ownership of the subsurface to find the United States owns both the surface and subsurface of acquired lands located in Montana.

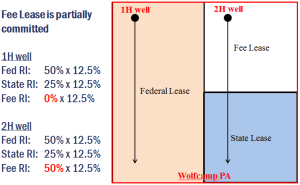

So what happens if the lessee’s working interest is committed to the unit agreement, but the lessor’s royalty interest is not? While the lessee will be allocated proceeds according to its proportionate share of the unit production area, the lessor will be allocated proceeds on a leasehold basis. This can result in a windfall either for the lessor or the lessee (compare the allocation of proceeds from the 1H and 2H wells in the diagram to the right, assuming 320 acre standup spacing units).

So what happens if the lessee’s working interest is committed to the unit agreement, but the lessor’s royalty interest is not? While the lessee will be allocated proceeds according to its proportionate share of the unit production area, the lessor will be allocated proceeds on a leasehold basis. This can result in a windfall either for the lessor or the lessee (compare the allocation of proceeds from the 1H and 2H wells in the diagram to the right, assuming 320 acre standup spacing units).